Cash on Cash Rate of Return w/ Integral Debt Coverage Service Ratio

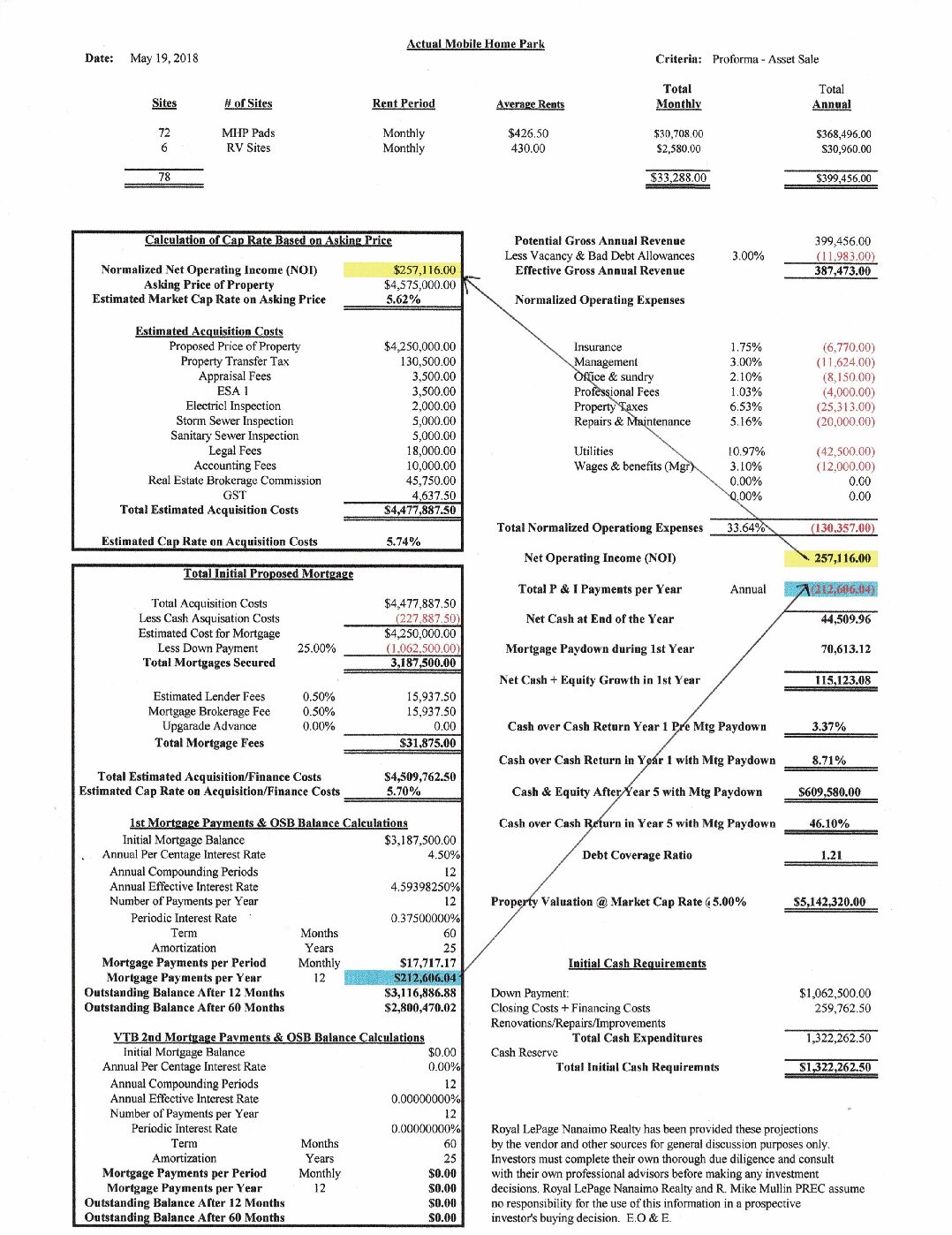

There are different ways to estimate a rental property’s financial returns. Most of them are complicated, like the Blended Discount Rate of Return and the Internal Rate of Return However, if it is a fairly simple rental property and you are not a real estate investment trust for example, over my career I have developed the one sheet shown above, which I call “The Cash on Cash Return with DCSR.” This includes the Net Operating Income Calculation, the Cap Rate, two mortgage amortizations, the pre mortgage paydown, the post mortgage paydown, debt covereage ratio, the property valuation at a specified cap rate and the initial cash requirements required to purchase the property. As an example. if you buy a bond that costs you $100.00 to purchase and it earns you $6.00 annual interest, its cash on cash return is $6.00/$100.00 or 6.00% annually. Residential rental properties, although they have more calculations, conceptually the calculation of the rate of return is no more complicated than the bond example.